Ibrahim’s opening

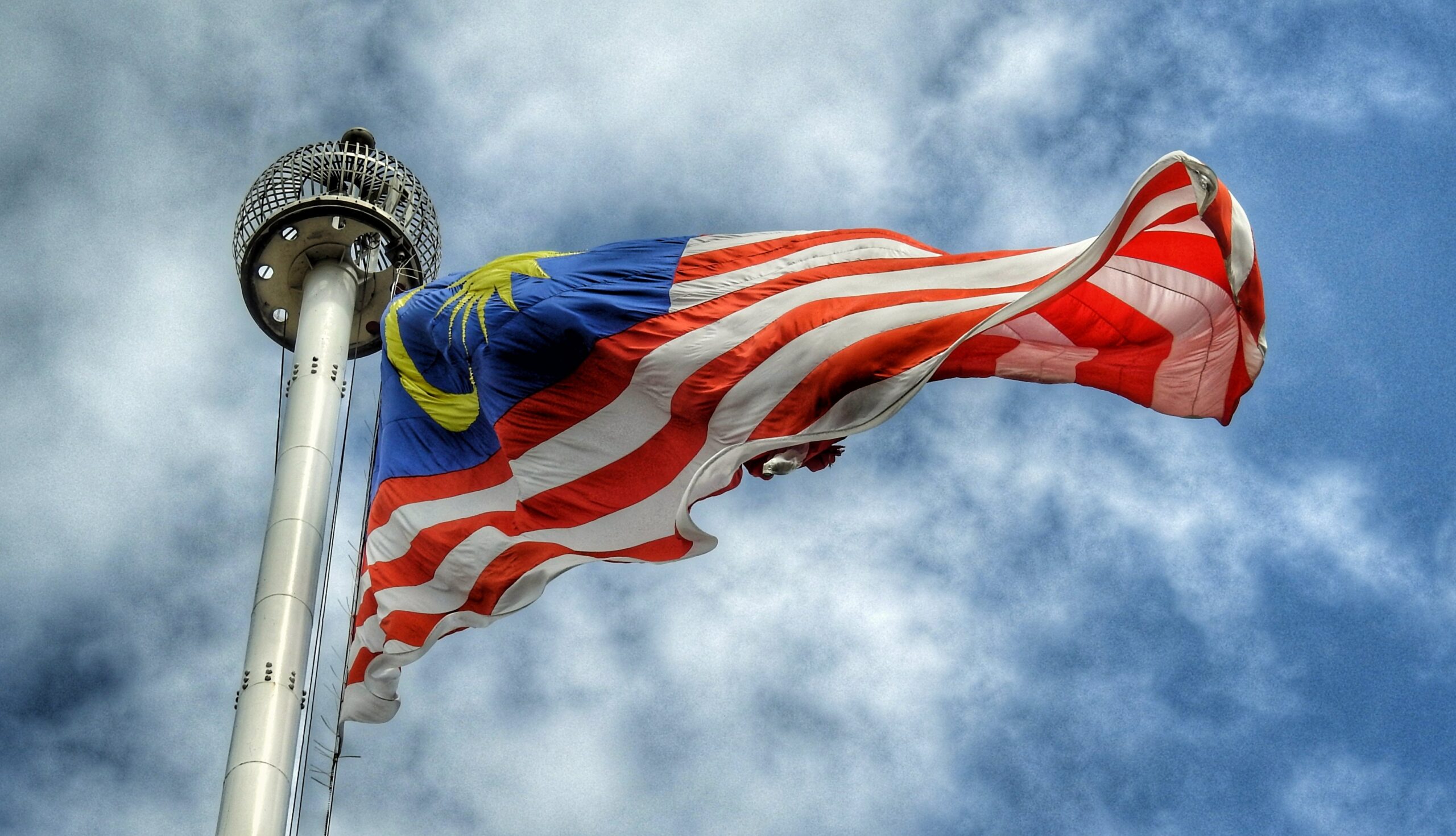

Malaysia’s relatively new Prime Minister, Anwar Ibrahim, who was sworn in two months ago, aims to help lower food prices and kick-start the country’s pandemic-battered economy.

Anwar recently said that bulk subsidies should be channelled to lower and middle income groups as well as small traders to help rejuvenate the south-east Asian country’s financial stability.

Political science professor Wong Chin-Huat of Sunway University told the South China Morning Post that dealing with the economy and cost-of-living issues is the top priority for Anwar — “the first yardstick [the public] is going to use to measure, to evaluate, this government.”

What can Malaysia expect?

The nation’s economic expectations for 2023 present a gloomy outlook in the first half and improving conditions in the second half, set to revive sectors like tech and construction.

Economists do not expect the nation’s strong economic growth witnessed in 2022 to continue into 2023 as consumer pessimism weighs significantly on growth.

Malaysia recorded double-digit economic growth of 14.2% in the third quarter of 2022, driven by a strong performance in many sectors, especially services and manufacturing.

A change is due

Economists speculate that domestic consumption could slow in a big way by late 2023 due to inflation. This could be further impacted by the government’s potentially more restrictive spending.

Cautious investor sentiment will see consolidation on the benchmark FTSE Bursa Malaysia Kuala Lumpur Composite Index (FBM KLCI) in the first half of 2023 due to the global economic slowdown, said UOB Kay Hian Malaysia head of research Vincent Khoo.

“Investors globally will be assessing the cumulative effects of interest rate hikes on economies, as well as anticipating economic and corporate earnings recessions in the Western world,” he told The Straits Times.

Spots of optimism

Businesses and services reopening after the pandemic will naturally benefit tourism-related stocks and firms that recruit foreign workers.

The likely recipients of fresh boosts of revenue would also include tech stocks, due to trade diversion arising from the United States’ sanctions against China, while the semiconductor recovery cycle will begin in the second half of 2023, he added.

Another major boost could be in the green sector, which benefits industrial metal smelters that are dependent on hydroelectric power, firms within the electric vehicle industry and, indirectly, selected oil and gas asset owners.

Brokerage firms also claim that construction stocks are expected to shine in 2023 after two years of the sector being throttled by multiple movement restriction orders due to Covid-19 outbreaks at worksites.

Banking on success

The Kuala Lumpur central bank decided to raise the overnight policy rate (OPR) by 50 basis points to 3.25% in the first half of this year.

Oil and gas counters look set to finish top of the gainers list due to China’s reopening, as its oil demand is expected to recover strongly in 2023, say analysts.

Our take

Anwar has a full inbox to deal with in getting the economy back to the recent heights his country hit.

However, with observers pointing to a period of relative stability under the new PM – especially in reigning in a militant Islamic movement – hopes seem strong that Malaysia can reinstate its reputation as a welcoming country in which many global companies can do business.